In einer Zeit voller gesellschaftlicher Herausforderungen muss das Engagement mit Geld einfach sein. So einfach, dass es hierfür keine Notare, Anwältinnen und hohe Einstiegskosten mehr braucht. So einfach, dass es keinen Grund mehr gibt, nichts zu tun.

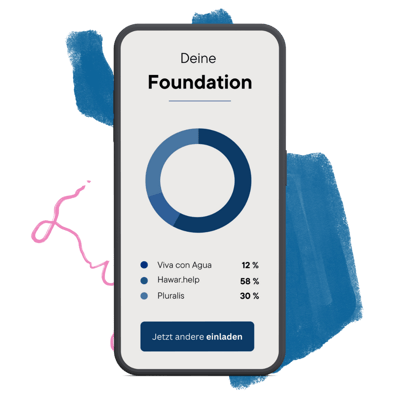

Mit bcause zeigen wir dir ein neues Geben, das Spaß macht. Das smart ist. Das du zeigen kannst. Wie? Mit deiner bcause Foundation.

In einer Zeit voller gesellschaftlicher Herausforderungen muss das Engagement mit Geld einfach sein. So einfach, dass es hierfür keine Notare, Anwältinnen und hohe Einstiegskosten mehr braucht. So einfach, dass es keinen Grund mehr gibt, nichts zu tun.

Mit bcause zeigen wir dir ein neues Geben, das Spaß macht. Das smart ist. Das du zeigen kannst. Wie? Mit deiner bcause Foundation.

.png?width=150&height=84&name=Logos%20%20press%20(1).png)

Die Gründung einer eigenen Stiftung steht für langfristiges und wirksames Engagement. Und war durch hohe Mindestsummen, Kosten und administrativen Aufwand lange Zeit nur für Wenige zugänglich.

Zeit, das zu ändern: Mit deiner Registrierung bei bcause eröffnest du einen Stiftungsfonds in unserer gemeinnützigen Treuhandstiftung und kannst sofort mit deinem Engagement loslegen.

-1.gif?width=1200&height=1200&name=Key%20visuals%20(homepage)-1.gif)

Zahle mittels Spende in deinen bcause Account ein und unterstütze empfohlene gemeinnützige Organisationen -oder investiere in ausgewählte Sozialunternehmen und Impact Fonds. Durch Rückflüsse kannst du dein Spendenguthaben vermehren und so noch mehr Organisationen damit unterstützen.

Anonym oder für andere sichtbar: Du entscheidest, wer von deinem Engagement erfahren soll.

Du wünschst dir maximale Sichtbarkeit und Transparenz für dein Geben oder möchtest dein ganzes Netzwerk zum Mitmachen einladen? Erfahre hier mehr über die Möglichkeit einer öffentlich sichtbaren Foundation.

.png?width=400&height=400&name=Key%20visuals%20(homepage).png)

Finanzierungen zeigen ihre größte Wirkung, wenn sie gebündelt werden und mehrere Unterstützer:innen vereinen. Statt Marketingslogans stehen auf bcause so echtes Engagement und klare Missionen der Nutzer:innen im Vordergrund. Dabei kann jede/r für sich selbst die passendste Sichtbarkeitsoption wählen und diese für jede Transaktion neu bestimmen. Denn wir sind überzeugt:

Wer Gutes tun will, kann aber muss nicht für sich bleiben.

"Spenden. Da fehlt noch was. [Mit bcause] können die User selbst steuern, ob sie ganz anonym, mit anderen zusammen wirken oder weithin sichtbar werden."

Zeit online

"Ruhendes Privatkapital mobilisieren – ohne Einstiegshürden und ohne Aufwand für Rechtsberatung und Stiftungsbehörden"

Handelsblatt

"So einfach wie aus seinem Depot in Aktien zu investieren. Wenn sich das Geld vermehrt, lassen sich die Erträge wieder reinvestieren oder spenden."

Finance FWD

"Eine digitale Stiftung ohne Zugangshürden. Mit Community... Ein Startup, das man jetzt kennen muss."

t3n Magazin

Felix Oldenburg ist Impulsgeber im Bereich Social Entrepreneurship, Impact-Finanzierung und Online-Innovationen. Vor der Gründung von bcause war er Generalsekretär des Bundesverbandes Deutscher Stiftungen und Vorsitzender von DAFNE (Donors and Foundations Networks in Europe). Sein Newsletter dreht sich um Fragen rund um Großzügigkeit, unseren Umgang mit Geld

und den vielen Menschen und Organisationen, die unsere Welt verbessern wollen.

-2.png?width=1200&height=1200&name=Website%20%20Key%20Visuals%20(1)-2.png)

Bei bcause gründest du keine rechtlich eigenständige Stiftung - das haben wir mit der Gründung der bcause Treuhandstiftung bereits für dich übernommen. Deshalb braucht es für den Start deines Engagements auf der Plattform auch keine notarielle Beglaubigung oder die Festlegung auf einen Stiftungszweck.

Deine bcause Foundation ist rechtlich gesehen ein Fonds innerhalb unserer gemeinnützigen Treuhandstiftung, in den du ganz einfach mittels Spende einzahlen kannst. In unserer Struktur sind wir damit Donor Advised Funds, wie sie in den USA bereits seit langem erfolgreich bestehen, am Ähnlichsten.

Die Registrierung bei bcause ist für dich komplett kostenlos. Für dein Engagement kannst du dich für 3 verschiedene Mitgliedschaftsmodelle entscheiden. Mit der Basis-Mitgliedschaft kannst du alle Organisationen bei bcause unterstützen und zahlst dafür jeweils eine geringe Transaktionsgebühr. Wenn du dich regelmäßig engagieren möchtest oder Interesse an einer öffentlichen Stiftung hast, in die auch andere mit einzahlen können, ist unser Premium-Modell für 170€ jährlich das Richtige. Mehr Informationen zu unseren Preisen findest du hier.

Unser Ziel mit bcause ist es, mehr private Vermögen zur Unterstützung von Organisationen und Sozialunternehmen zu mobilisieren. Dennoch können Organisationen sich auf bcause nicht selbst registrieren oder direkt Spenden einwerben. Sie werden jeweils von Mitgliedern vorgeschlagen, die sie über die Plattform unterstützen möchten. Durch das Engagement eines bestehenden Mitglieds erhöht sich gleichzeitig die Sichtbarkeit einer Organisation für andere bcause Mitglieder.

Nein. Eine Online-Stiftung gehört einer Einzelperson. Spenden können nur von Organisationen empfangen werden, die vom Finanzamt als gemeinnützig anerkannt sind.

©2021-2023 bcause

gut.org invest GmbH

Schlesische Straße 26

10997 Berlin

hallo@bcause.com

©2021-2024 bcause

gut.org invest GmbH

Schlesische Straße 26

10997 Berlin

hallo@bcause.com